Premises

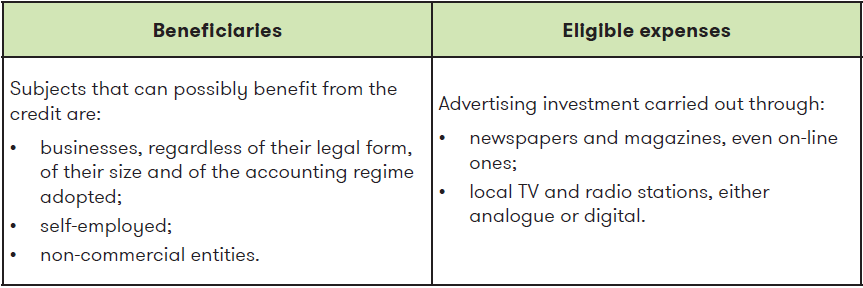

As part of the supporting measures set forth under the Relaunch Decree (Law Decree n. 34/2020), Art. 186 provides for an amendment of the regulation of tax credit for advertising investment (art. 57-bis of Law Decree n. 50/2017, Prime Minister Decree n. 90/2018) by introducing an extraordinary regime, for 2020 only, aimed at incentivising advertising investments through newspapers and TV broadcasters.

The new definition of the credit

With reference to 2020, the tax credit is defined by applying a 50% rate - instead of the previously set 30% rate, introduced by the Cura Italia Decree - on the total advertising investment carried out, with no need to consider only incremental investment.

The new regulation provides for the introduction of a public spending limit to cover the benefit in point, of 60 million euros. 40 million euros shall be for advertising investments made through daily newspapers and periodicals, including online ones; and 20 million euros for advertising investments made on local and national television and radio stations, either analogue or digital, not owned by the State.

Procedure to apply for the credit

The possibility to apply for the credit is subject to the filing, during the year, of a specific electronic communication to the Department for information and publishing of the Presidency of Ministers, containing information on advertising investment already carried out or that are going to be carried out. As concerns 2020, this communication can be filed from September 1st to September 30th.

During the following solar year, the actual amount of eligible costs incurred will have to be certified by filing a Substitute Return. Together with this return, it will also be necessary to request for an attestation - to be issued by subject qualified to issue a stamp of approval or by auditors - aimed at certifying the expenses actually incurred.

How to use the credit

The tax credit, in compliance with art. 17 of Legislative Decree n. 241/1997, can exclusively be offset in the F24 form to be filed through the electronic channels made available by the Italian Inland Revenue.

The benefit is granted in compliance with the current regulation concerning the application of “de minimis” aids (EU Regulation no. 1408/2013). The tax credit cannot be combined with other facilitations related to the same expenses.

Our professionals would be pleased to provide you with any further information you may need.