The Italian Government has approved a draft decree containing relevant changes to the existing tax regime for inbound workers. The proposed changes (still to be confirmed) impact both the conditions to access the favourable tax regime and the tax advantage itself.

The modifications and novelties only impact the Special Tax Regime (STR) for inbound. The other special tax regimes provided by the Italian legislation (namely the so-called “HNWI regime” or “Flat-tax regime”, regime for university professors and researchers and the special regime for pensioners) are not impacted by the changes currently under discussion and remain in place with no modifications of any kind.

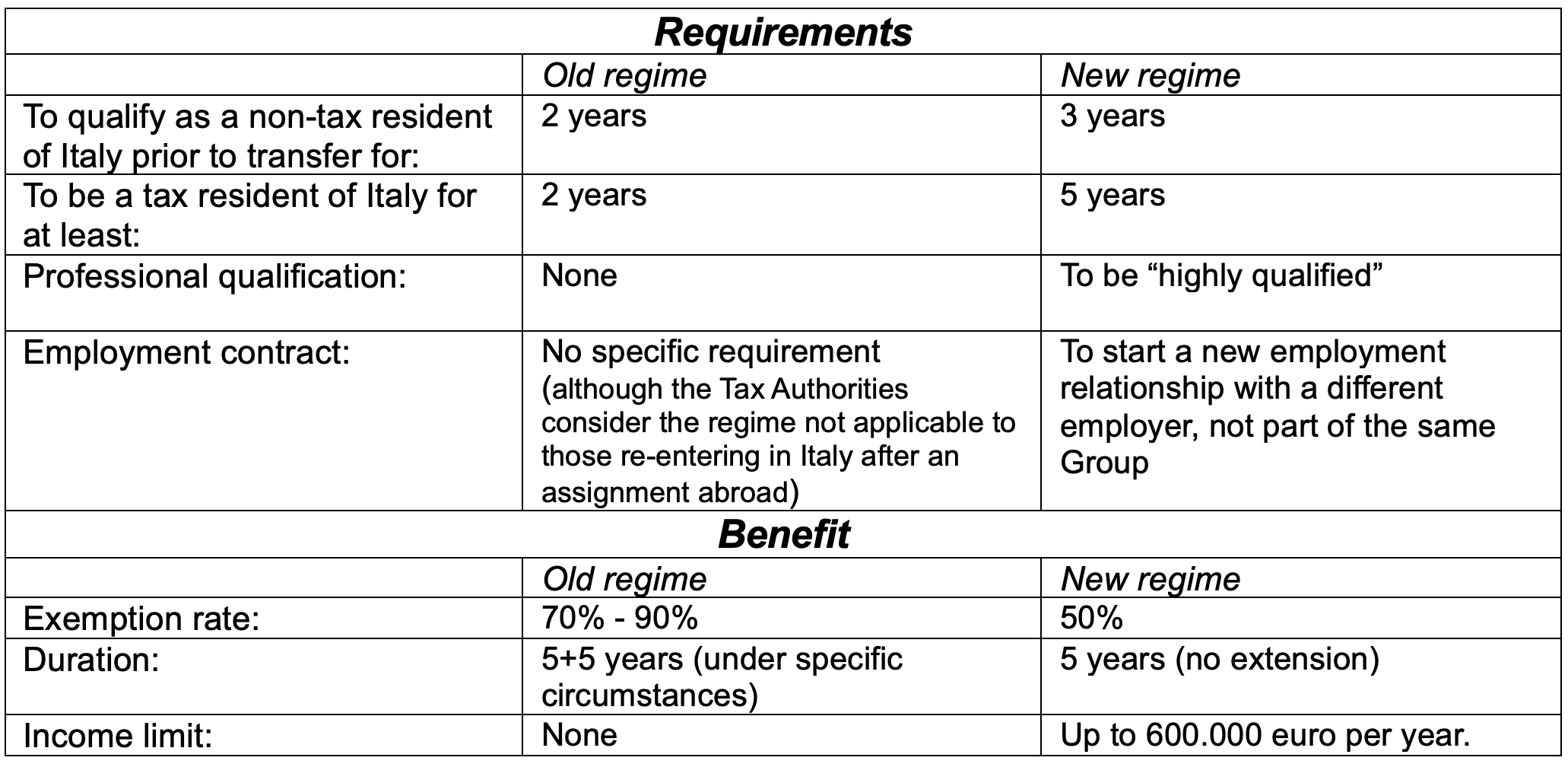

The table below summarizes the main changes currently under discussion.

The modifications should be effective starting from January 1st, 2024 and should only affect inbounds becoming tax resident of Italy after such date. Inbounds who became tax resident of Italy according to the Italian tax rule prior to 2024 should not be impacted (although it is unclear if they will still be able to opt for the extension of the benefit after the initial 5-year period).

As a result of the novelties under discussion, the new tax regime seems to become more focused and addressed to individuals taking up a new employment relationship in Italy and establishing a strong connection with the Italian territory and economy. In this sense, the application of the special tax regime to remote workers (working for the same foreign employer) or assignees seems to become more difficult. Italy do not have any specific regime dedicated to digit nomads, although a law was proposed years ago.

It must be highlighted that all these novelties are currently under discussion and are not a law yet. Modifications cannot be excluded until the publication of the law. By way of instance, in various interviews the vice-minister most involved in the drafting of the new version of the STR has affirmed that the old version of the regime will be applicable to individuals arrived or arriving to Italy in 2023 and registering in the Register of the Resident Population (“Anagrafe”) before December 31, 2023.

Considering that the amendments are not a law yet, should the legislator decide to eliminate the requirements regarding the employment contract, the scope of application of the regime would not be dramatically impacted.

At the same time, the legislator is also reviewing the criteria to qualify as a tax resident of Italy. The new criteria will consider as “Italian days” all those days during which even a portion was spent in Italy. For the purposes of adopting the STR for inbound (or one of the other special tax regimes), the new residency criteria could facilitate the qualification as a tax resident of Italy, hence the application of the STR. All the modifications mentioned in the present document are currently being discussed by the Italian Government and are expected to be effective starting from 2024. It is reasonable to expect the approval of the final law by the end of the year.