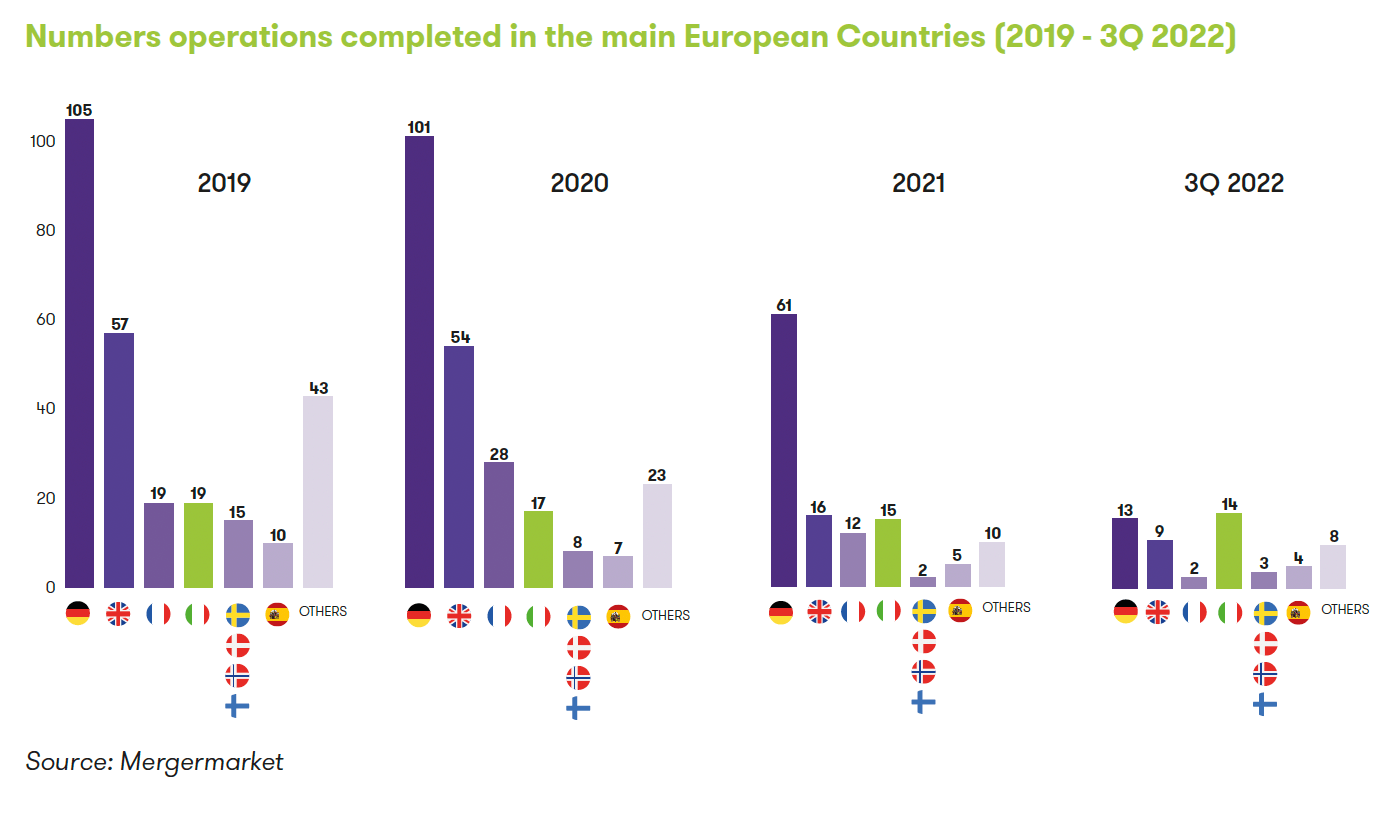

The distressed M&A segment registered a significant contraction over the last three years: in Europe, the number of transactions on distressed companies halved from 268 deals in 2019 to only 121 in 2021. It is clear that this trend is related to the pandemic crisis, which caused structural changes in the whole economic and legislative system.

In fact, in order to face the economic and financial crisis caused by the lockdown period, starting from 2020 the main European economies have implemented government measures aimed to rescue businesses and to safeguard their wealth. Such measures, such as the freeze of insolvency proceedings, the moratorium on financial debts, secured and non-repayable funding, implied the sudden freeze of most deals.

The same trend was registered in the Italian market, even though with reduced numbers, as the number of transactions carried out decreased by about a quarter between 2019 and 2021, recording a (slight) growth in 2022, since transactions carried out were 14 in the first three quarters of the year.

At a domestic level, the sector of greatest interest to turnaround strategic and financial players was that of consumer goods, with a specific focus on the fashion industry, which is traditionally subject to corporate restructuring operations.

Between 2021 and 2022, 6 deals were finalized on targets operating in the fashion industry, representing 20% of total deals. Among the most important turnaround operations there are: operations on Corneliani SpA, a well-known luxury menswear brand, by Invitalia and the English fund Investcorp; operations on Jeckerson SpA, owner of the homonymous denim trousers brand, by the Milan investment bank Mittel, and on Canepa SpA, historical textile company in the Como area, which was subject to a restructuring operation thanks to the combined action of the German investment fund Muznich&Co and of Invitalia.

A more significant growth should be registered with regard to distressed M&A transactions: the persisting geo-political uncertainty, the progressive increase in interest rates and the interruption of safeguarding measures already occurred during 2022 will be the main drivers that will push industrial and financial players to consider more investment opportunities aimed at the recovery of financially distressed companies.