In the ten-year period 2013-2023, the number of Small sized operators has decreased dramatically. At the same time, there was a growth trend for both Mid and Large funds. This trend clearly reflects the resilience of medium and large funds and their ability to adapt to complex and changing economic and financial dynamics. Their ability to cope with volatility and uncertainty periods, quickly adapting to market changes, underlines the strength of their investment strategies. Furthermore, this resilience not only demonstrates the robustness of the funds, but also their flexibility in responding to various external factors, ensuring a constant and sustainable performance over time.

Over the years, there has been a marked increase in competitiveness, fuelled by the accelerated development of technological innovations useful for competing in many industries. These innovations, which are increasingly advanced and revolutionary, require significant investments. The rapid and constant evolution of technologies has forced operators to adapt quickly and invest massively to ensure that investments bring competitive results on the market.

The trend of Small operations has been progressively decreasing, since it has become clearer that the implicit cost of a small operation, as well as its risk, is not optimal for either the fund or its investors. The cost of completing an investment transaction is substantially the same, regardless of the size of the transaction itself. Moreover, over the years it has been observed that the failure rate of small companies is higher than that of large companies, mainly due to different economic circumstances.

Increasing the size of the investment leads to benefits related to economies of scale and, above all, reduces the intrinsic risk of the company and the operation. Considering the above, the MID segment represents the most widespread ticket, precisely to mitigate risk and take advantage of the economies of scale.

As regards the performance of Large funds, it must be considered that they are very limited. The large funds capable of implementing Mega Deals or Large Buyouts represent a limited number and are mainly US-based. The funds that operate with such investments are always the same over the years and it is difficult for new ones to be formed. Furthermore, large funds have difficulties in selling portfolio companies as they are too large to sell. The only solution would be to sell them to other private equity funds of equal size.

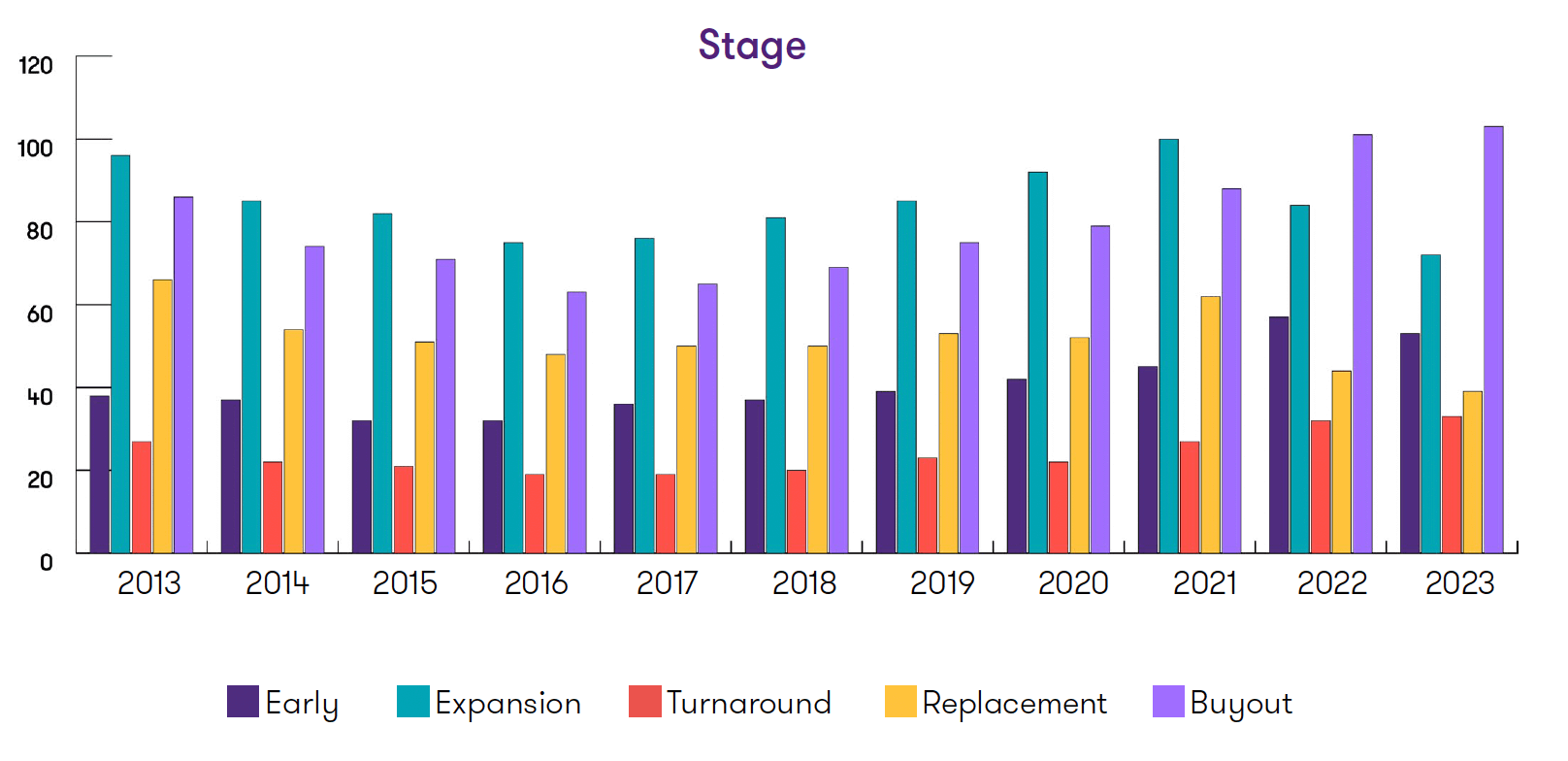

Until 2021, investments were more focused on Expansion and Buy out. In recent years, however, many operators have decided to focus almost exclusively on buyout-type investment activities.

This strategic shift can be attributed to several factors. Buyouts offer greater opportunities for corporate control and restructuring, allowing investors to quickly implement operational and strategic improvements. This positioning may also be fostered by the changing trends caused by the pandemic.

Private equity funds have preferred Buy out as their main strategy, considering it as a safer and more profitable approach than Expansion, which can involve greater risks in an uncertain market environment. Furthermore, during the extraordinary crisis period due to Covid and the pandemic, entrepreneurs have shown deficiencies in management and business strategy, leading funds to intervene to avoid the collapse of companies and leading them beyond the difficult situation. This highlighted the importance of having full control of corporate governance, in order to be able to overcome crisis situations. In fact, funds that did not have majorities suffered significant losses.

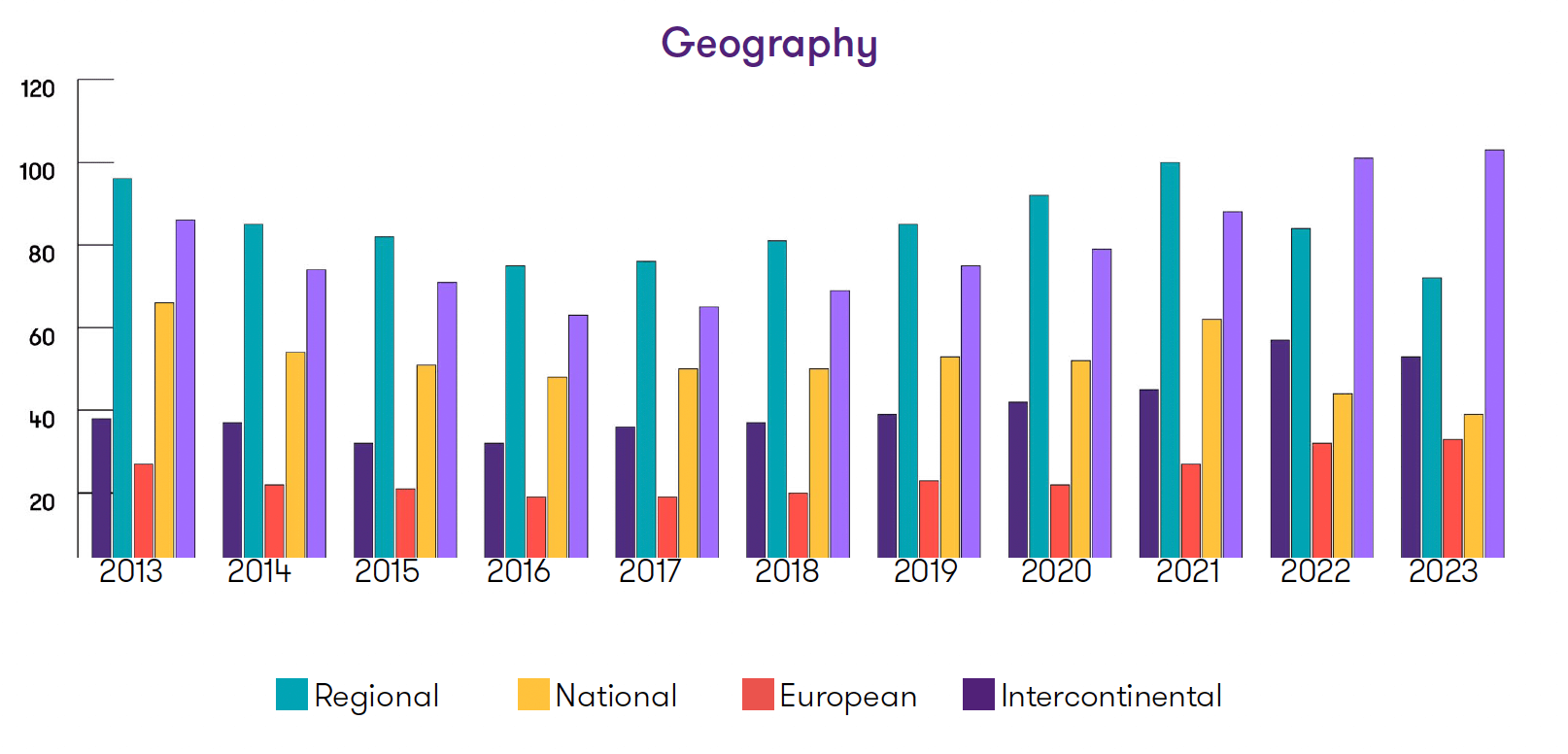

In the investment landscape, the domestic sector continues to be preferred by a significant number of operators, which choose it as the heart of their investment strategies, thanks to their experience and in-depth knowledge of the Italian economic system. Numerous funds invest on projects aimed at the development of Italian SMEs in all stages of growth. However, over the years, there has been a constant decrease in the number of operators active at a regional level. This decreasing trend reflects a substantial transformation in the sector's investment strategies. Regional funds are highly specialized in investing in small companies. Therefore, the decreasing trend over the years is a consequence of the decrease in Small-type funds. In fact, the cost of small investments at regional level in small businesses is not optimal, as it is comparable to the cost of a larger investment.

Private equity funds are progressively shifting their attention towards diversification on a domestic and international scale. This decision is driven by a series of strategic and economic reasons. Diversification towards a broader geographic scope allows, first and foremost, to mitigate the risks associated with specific local markets, offering greater resilience to events that can affect a single region. During the period, there has been a globalization of information and technologies which has allowed many investments to increase the value and competitiveness of companies within their investment portfolio. Furthermore, over the years, investments have allowed small Italian SMEs to grow by adopting an international perspective and turning into small multinationals.

The growing phenomenon of European investments reflects the evolution of a European culture and a single market over the years. This has fostered relationships between companies and facilitated the business aggregation process. Geographical expansion was also possible thanks to the constant analysis of the market and trends for each industry, which allow companies to adapt and compete beyond the domestic territory.

As for the breakdown of investments by industry, the investment strategies implemented in the last decade were diversified, involving different industries over various years. The decrease in the number of industries covered by the investments shows how PE funds have rethought their positioning and generalist strategies over the years to try and specialize on specific sectors, in line with international trends, especially in the Anglo-Saxon world.

Some sectors have been under attention for a few years and then abandoned. On the contrary, some other sectors have been in the limelight of investment strategies during the whole decade. The Healthcare, Industrial Products and Services, Manufacturing and Food and Beverage industries are among the most coveted by private equity funds, for various reasons:

- the healthcare industry is characterized by a constant demand driven by continuous medical and technological progress. The growing innovation offers significant high-yield investment opportunities;

- the industrial products and services industry is broad and diversified in nature. The continuous modernization of the various industrial sectors provides opportunities for a diversification of investments;

- the manufacturing industry plays a key strategic role as the pillar of the global economy which provides essential goods to various other industries;

- the food and beverage industry responds to a universal and continuous demand, as it deals with goods that meet primary needs, thus guaranteeing a constant demand and a stable and long-term investment opportunity.

Over the last few years, a significant increase in the interest towards the Energy and Environmental sector was also recorded, driven by various factors, the main one being the growing awareness towards sustainability and the development of renewable and sustainable energy.

The growing concern towards climate change and the environmental impact of human activities led to an increased awareness of the challenges related to the supply and use of energy sources. As a result, investors are increasingly focusing their attention on cleaner and more sustainable energy solutions. Alongside with the increased attention towards renewable energy, there is a growing interest in technology and solutions aimed at improving energy efficiency and reducing waste. This includes investments in technology for energy efficiency in buildings, transportation and industry, as well as solution for waste management and recycling.